|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

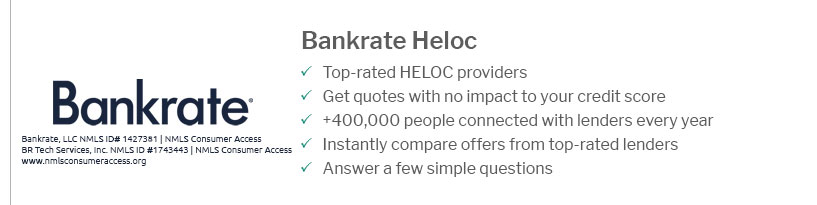

Understanding HELOC Rates in Massachusetts: A Comprehensive GuideHome Equity Line of Credit (HELOC) rates in Massachusetts can vary significantly based on several factors. Understanding these rates is crucial for homeowners considering leveraging their home's equity. This article will explore the basics of HELOC rates, what influences them, and provide answers to common questions. What is a HELOC?A Home Equity Line of Credit, or HELOC, is a loan that allows homeowners to borrow against the equity of their home. Unlike a traditional loan, a HELOC gives you a revolving line of credit to use as needed. How Does a HELOC Work?

Factors Affecting HELOC Rates in MASeveral key factors influence the interest rates of HELOCs in Massachusetts: Market ConditionsInterest rates are heavily influenced by the broader economic environment. A stable or growing economy can lead to lower rates, while economic uncertainty might cause rates to rise. Credit ScoreYour credit score plays a significant role. A higher credit score often results in more favorable rates. It's a good idea to review your credit score before applying. Loan Amount and Loan-to-Value RatioHELOC rates can also depend on the amount you intend to borrow and the loan-to-value ratio of your home. A lower ratio often results in better rates. Comparing HELOC to Other Loan TypesWhen considering a HELOC, it's helpful to compare it with other loan options. For example, a 30 year fixed mortgage might offer more stability with fixed payments but lacks the flexibility of a HELOC. Benefits of HELOC

FAQ SectionWhat are the typical interest rates for HELOCs in Massachusetts?HELOC rates in Massachusetts can vary but generally range between 3% to 8%. The specific rate depends on your credit score, the loan amount, and market conditions. Can I switch from a HELOC to a fixed-rate loan?Yes, many lenders allow you to convert a portion or all of your HELOC to a fixed-rate loan, providing more predictable payments. How does the draw period affect my HELOC?During the draw period, you can borrow from your credit line and often make interest-only payments. Once this period ends, you enter the repayment phase, which requires paying both principal and interest. Is a HELOC better than a 250k 15 year mortgage?It depends on your financial needs. A HELOC offers flexibility and potentially lower initial rates, while a 15-year mortgage provides fixed payments and could save on interest over time. https://www.rocklandtrust.com/personal-banking/loans/home-equity-rates

Prime Rate is 7.50% as of March 3, 2025. The Annual Percentage Rate (APR) quoted is the lowest rate available as of March 3, 2025. https://www.massbaycu.org/products/heloc/

Minimum rate 3.75% and maximum rate 18.00%. 10 year draw period. 15 year repayment period. Minimum $10,000 draw at closing and $1,000 advances thereafter. The ... https://www.metrocu.org/home-equity-rates

Current Prime Rate is 7.50%. Maximum APR is 18.00%. Minimum APR 3.25% for HELOC 477. $500.00 penalty for early termination within the first 36 months.

|

|---|